Insurance

26 March 2024

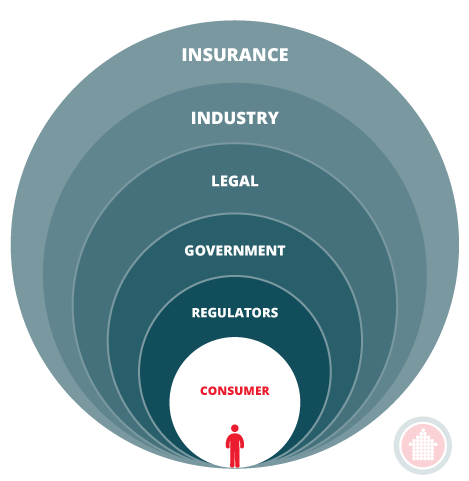

In this industry representation, the largest sphere by volume is a major stakeholder, namely the insurance industry. A long-standing player in the space, they command an authoritative position and interact with the other sectors regularly as shown by the following excerpts. This level of cross-subsidisation, endorsement, and solidarity between the regulators and “the regulated” creates substantial credibility issues in the eyes of the Victorian public.

What were doing: Building Stronger Homes Roundtables

Throughout 2020 and 2021, the Insurance Council has partnered Master Builders Australia in conveying the ‘Building Stronger Homes’ Roundtables series.

Engaging industry bodies, governments at al levels and leaders from across the building and property industry, the Roundtables have developed strong policies to improve the durability of homes, to provide for more contemporary planning arrangements and facilitate resilience within the built environment.

Building Surveyors Career Pathways

The VBA partnered with the Victorian Managed Insurance Authority(VMIA) and DBDRV to launch the Inaugural Building Surveyors Career Pathways Program in February 2021. This followed the State Government’s announcement in January 2021 to found to 40 roles to train female building surveyors in Local government.

This program is open to recent graduates and final year students undertaking building surveying Qualifications. In 2021, six cadets commenced the program and will spend six months in each organization over an 18 month period, gaining invaluable skills and knowledge, learning while Contributing to the vital work of each organization.

Professional Indemnity Insurance Challenges

In August 2019 and January 2020 the government made changes to ministerial orders relating to professional indemnity insurance (PII) for building surveyors, inspectors, engineers and draftspersons. These challenges allowed PII to include exclusions relating to non compliant cladding. This action was in response to ongoing pressure from the insurance market responding to global consequences from the inappropriate use of combustible cladding. Some insurers left the market and those remaining substantially increased premiums and excesses.

Continuing the theme, Victorian Builder’s Warranty Insurance is informally referred to as insurance of last resort or junk insurance. There are now, only a handful of insurers who do BWI but here is a description directly from the Victorian Managed Insurance Authority’s website.

“The VMIA. is the Victorian Government’s insurer and risk advisor, covering the people, places and projects that help Victorians thrive.”

“We are also here for Victorian homeowners embarking on domestic building projects, offering cover to protect one of the biggest investments Victorians make in their lives. And because we operate across Victoria” public sector, we’re uniquely placed to connect experts and decision-makers with world-leading thinking and insights. This leads to smarter ways of working and partnering to prevent harm. It underpins our purpose – to build a confident, resilient Victoria through world-leading harm prevention and recovery.”

Whilst some of the motherhood statements have implied meanings, the community at large rightly or wrongly interprets BWI to cover poor workmanship, negligence, and criminal behaviour, yet here are the terms and conditions of a BWI insurance claim.

When can I make a claim?

You can make a claim if VMIA is the insurer and your building or renovating project has incomplete or defective works and:

- Your builder has died, disappeared or become insolvent; or

- For policies issued on or after 1 July 2015, your builder has failed to comply with a Tribunal or Court Order in the way described in the policy wording.

If you think your builder has died, disappeared or become insolvent, you will first need to know how your builder is trading i.e. are they operating as a sole trader, a partnership or as a company.

Unpacking the dot points, the policy is of little value given the absurdly narrow terms and conditions and significant payment limitations. The second dot point really tells you nothing and shows how this policy got the nickname “junk insurance”.

Fiona O’Hehir & the Team

Having encountered many of these issues, we simply want to share experiences to assist others to avoid what we did not. We are not lawyers, nor do we give advice.